February home sales were down from the all-time high set in 2021, but they were still the second-best February performance in history. New listings fell, although at a slower yearly rate than sales, indicating a gradual shift toward a more balanced market. However, buyer competition remained fierce enough to support double-digit price increases year over year.

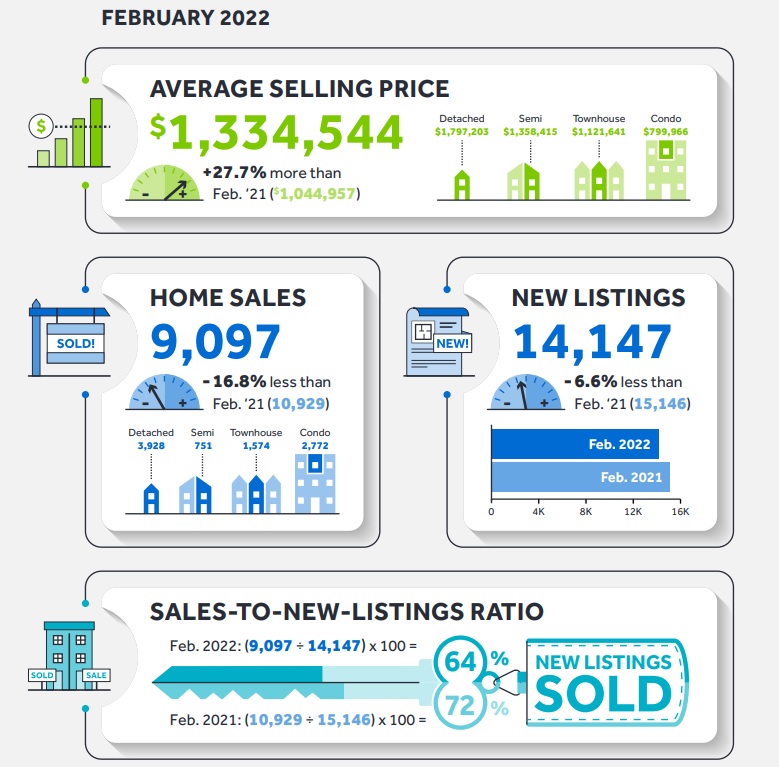

In February 2022, REALTORS® in the Greater Toronto Area (GTA) reported 9,097 transactions through the Toronto Regional Real Estate Board’s (TRREB) MLS® System, a 16.8% reduction in sales from February 2021. Low-rise home listings (detached, semi-detached, and townhouses) were also down year over year, but not by nearly as much as sales. In the condominium unit sector, particularly in Toronto, new listings were up by comparison to Feb 2021.

“Demand for ownership housing remains strong throughout the GTA, and while we are marginally off the record paceseen last year, any buyer looking in this market is not likely to feel it with competition remaining the norm. Manyhouseholds sped up their home purchase and entered into a transaction in 2021, which is one reason the number ofsales were forecasted to be lower this year and a trending towards higher borrowing cost will have a moderating effecton home sales. Substantial immigration levels and a continued lack of supply, however, will have a countering effect to increasing mortgage costs,” said TRREB President Kevin Crigger.

In February, the MLS® Home Price Index Composite Benchmark increased by 35.9% year over year. The average selling price for all types of homes increased by 27.7% to $1,334,544. The rate of price growth varied by home type and region, although low-rise and condominium apartment growth rates were nearly identical.

“We have seen a slight balancing in the market so far this year, with sales dipping more than new listings. However, because inventory remains exceptionally low, it will take some time for the pace of price growth to slow. Look for a more moderate pace of price growth in the second half of 2022 as higher borrowing costs result in some households putting their home purchase on hold temporarily as they resituate themselves in the market,” said TRREB Chief Market Analyst Jason Mercer.

“We are close to provincial and municipal elections in Ontario. We know that housing affordability will be top of mind. Parties and individuals vying for political office must concentrate on bold and creative policies that will support increased and diverse housing supply to account for the current deficit and future population growth as immigration accelerates. History has shown that tax based policies pointed at foreign buying and speculative activity, which seem to be the political preference, have had very little impact on the market simply because this type of activity accounts for a small share of overall market activity,” said TRREB CEO John DiMichele.